Next up in our analysis series on who invests in who, we have attempted to illustrate three examples of the chain of investment between different companies.

While much of this information is publicly available through directories like Crunchbase, many HE professionals, entrepreneurs and leaders will be unaware of the investment links in the industry.

These articles aim to signposting our readers to find out more. They do not include a timeline for investments and we would encourage interested parties to further research the wider factors behind patterns of investment.

ETS

ETS Strategic Capital is the corporate development unit of ETS, the world’s largest private educational testing and assessment company.

As a not-for-profit organisation it uses excess capital to invest in and partner with innovative companies to advance education globally.

As a venture capital fund that is solely focused on the education sector it is possible to envisage strategic links between companies in their portfolio but we cannot confirm cross-company support.

The ETS investment portfolio includes some of the hottest disruptors in the sector:

- ApplyBoard (Investment)

$1.4 billion valued student recruitment aggregator - CIEE / TOEFL assets (Acquisition)

Japanese assets of the global English language test - Class (Investment)

Virtual classroom integration with Zoom - CollegeDekho (Investment)

Indian study abroad counselling service attracted $49m investment - Degreed (Investment)

Upskilling platform that certifies experience and expertise - GradSchoolMatch (Acquisition)

Graduate school online search and application tool - MPower Financing (Investment)

Fintech offering educational loans - UpGrad (Investment)

Multi-platform HE provider, study abroad and employability services

As is common with venture capital investment, many of the companies backed by ETS has attracted large amounts of total investment from a wide range of firms to amass substantial funds. These include UpGrad ($668.2m), MPOWER Financing ($525m), ApplyBoard ($491.2m) and Degreed ($462.7m).

ETS has also reportedly led a new funding round in study abroad platform and ApplyBoard competitor, LeverageEdu.

The org-chart below outlines a section of the ecosystem, where you can see how the companies ETS has chosen to invest in, also make their own strategic investments and acquisitions.

Many readers will be able to deduce which of these private companies has former public sector partnerships with universities and colleges.

We have also highlighted the funding link between ETS and MPOWER Financing which in turn works with a wide range of partners who now use its student finance products. For example Studyportals announced a deal with MPOWER Financing to offer financial support for students.

While this is not a direct investment, we feel it is interesting in highlighting how ETS funding enables strategic partnerships further down the line, even passing to students in the form of finance.

This is a snapshot diagram to illustrate a few connections, and the full map of investment and partnerships is far greater.

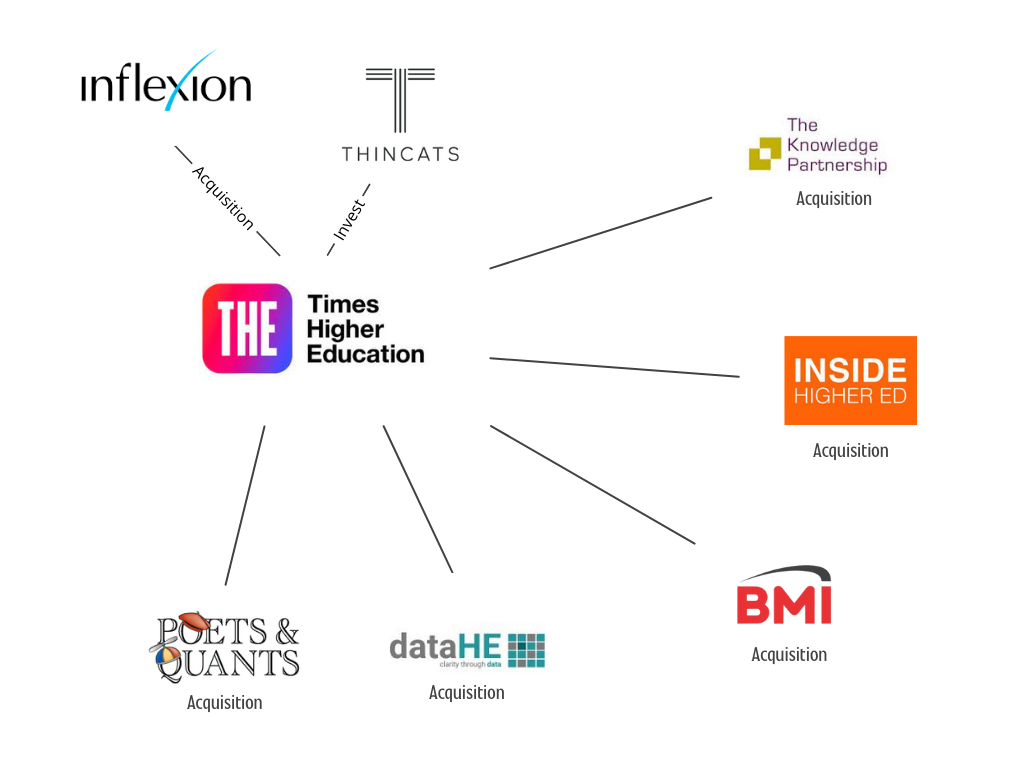

Inflexion and Times Higher Education

In 2019 Times Higher Education was separated out from the wider TES Global business and acquired by Inflexion, a mid-market private equity firm, investing in high growth businesses, for an undisclosed fee.

Inflexion is not a specialist in the education sector and has a wide ranging investment portfolio that includes everything from insurance companies to roofing firms.

Since the acquisition however, the newly independent THE business entity has been able to debt-fund £5 million via ThinCats to support a series of strategic acquisitions itself.

The Times Higher Education investment portfolio includes:

- The Knowledge Partnership (Acquisition)

HE strategy, marketing and communications agency - Insider Higher Ed (Acquisition)

US-based news, events and jobs platform for HE - dataHE (Acquisition)

Data analytics services for British universities - BMI Global (Acquisition)

Worldwide recruitment fairs and counsellor accreditation - Poets & Quants (Acquisition)

Platform on graduate business school content

While some detractors of corporate acquisitions highlight concerns about asset stripping, the additions from THE appear to be part of a wider, holistic strategy to complement the whole business including insights and consultancy, rankings and leveraging audience segments.

In addition to the Times Higher Education World University Rankings, two newer platforms have been created by THE in the form of THE Student and THE Counsellor.

The acquisition of Poets & Quants, Inside Higher Ed and BMI Global all cross-feed content, commercial opportunity and new audiences to these new platforms and the heavy organic traffic created by the university rankings.

Through debt-financing THE has managed to make a series of strategic acquisitions in recent years.

Kaplan

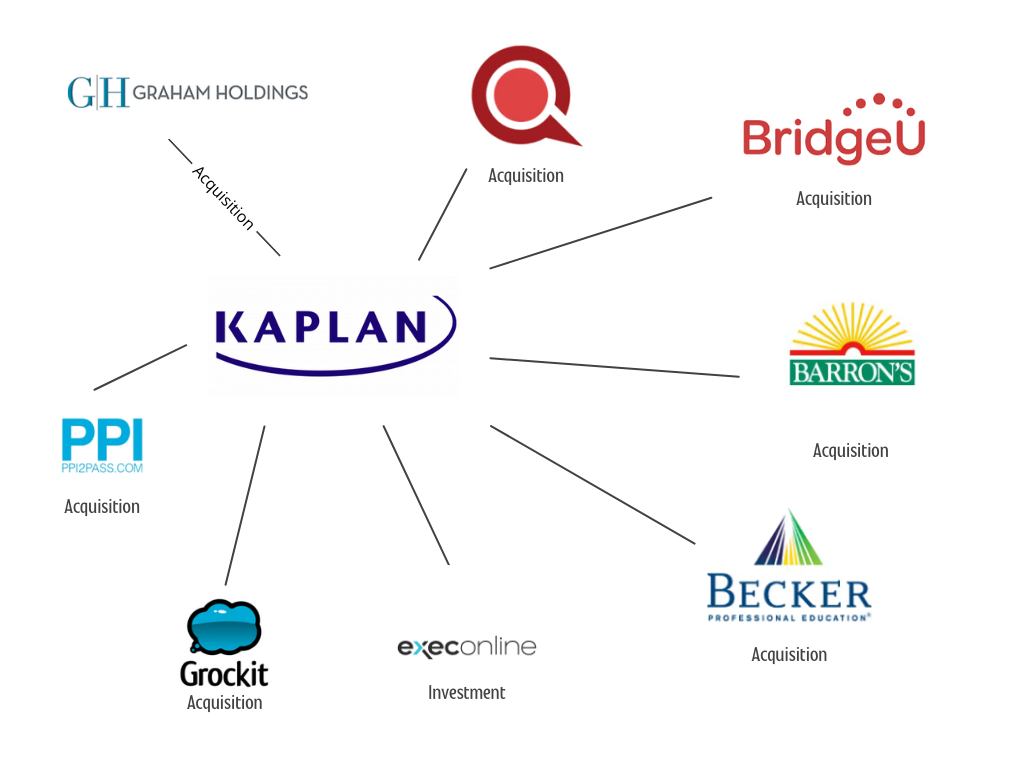

Our final example is Kaplan Inc., the largest subsidiary of holdings group Graham Holdings Company, formerly known as The Washington Post Company.

In recent years Kaplan has made a series of acquisitions to keep pace with the increased digitisation of education.

While these companies continue to operate in their own right, it is possible to link the expertise and technology they offer in digital teaching, accreditation, application, exam prep, adaptive learning and compliance proctoring to the development of Kaplan’s own products.

The Kaplan investment portfolio includes:

- BridgeU (Acquisition)

A guidance platform that connects K-12 learners with universities - Becker Professional Education (Acquisition)

Exam prep in healthcare, CPA and CPE - Barron’s Education (Acquisition)

Digital test prep including digital SAT and AP resources - PPI (Acquisition)

Exam prep materials and course guides - Red Marker (Acquisition)

Analyses digital content for compliance risk - Grockit (Acquisition) Defunct 2016

An adaptive learning engine and game content - ExecOnline (Investment)

Leadership course in partnership with top business schools

Kaplan is owned by Graham Holdings Company. It has made a series of acquisitions and investments to complement its core business.

In the next instalment of this series we will be taking a look at two early-stage edtech investment funds in Emerge Education and Owl Ventures and who they have backed in the international education space.

The post Who invests in who? ETS, Inflexion & Graham Holdings appeared first on The PIE News.